A year end. And begins another.

Many things had happened for year 2020, the most dramatic was none other than the covid-19 pandemic and its impact on the world. Not only it had inflicted loss of human life, it had transformed the life of many people around the world. The borders between countries were forced to close, trade halted, people were trapped at home with limited human interactions. Fear and panic occurred on different scale across the countries affected. The race against time to find a cure til now is still on, although vaccine has been developed, its results is yet unknown as the pandemic continued to work its havoc over the world of human race.

The pandemic has brought about drastic changes in human movement. Gone are the days of an vibrant office environments, meetings now has to be held through Skype and Zoom, more than ever now we have to rely on technology to get their messages across and assignments to be carry out.

Singapore as a small nation relying on foreign investments and international trades faced its greatest challenges since the financial crisis 2008. As a city state, the vibrant scene of shopping malls and tourism has been the main features of the country. The impacts of pandemic has changed everything, retail business struggled to sustain in the face of shrinking customers and the loss of tourists. When the storms end, our world will never be the same again.

45% of Singapore population are foreigners working or staying in Singapore as work permit holders or permanent residents. The transformation of the working environments meant that works and assignments are transmit through network. This totally closed the physical barrier of distances between the parties involved, without the need to meet at a designated location or venue. What would be the impact on us? If the foreign executive talents can fulfill their assignments working from home, it is likely they could do it from their own native home without the need to come to Singapore.

First thing that comes to mind, when these pool of foreign executives no longer need to stay in Singapore to fulfill their jobs, this may indirectly results in shrinking pool of potential tenants. Rental income especially for higher grade accommodations like condominiums which has been among the favor type of house for executives may faced difficulties in future.While the pool of potential executives tenants may shrink in future, the pool of skilled workers however should continued to remain in demand as the job scopes of skilled workers required them to remain in the country due to the nature of their jobs. These group however are not among the higher tier salaried jobs, and tend not to look for rental house in condominiums as these require higher maintenance and expenses.

Our own experience with the impact on the rental market occurred in April and May as Singapore government enforced the first phase of the covid-19 restrictions, our tenants are a group of skilled workers whose livelihood were affected as they were forced to stay at home with no salary. In view of the events, we lowered the rental by 30% to help our tenants as half of them were unable to generate income due to the working restrictions. While this lessened our passive income, it provided better sustainability in retaining the tenants. I believed landlords should adjusted with the changing times to constantly meet the market demand to ensure more sustainability and stability.

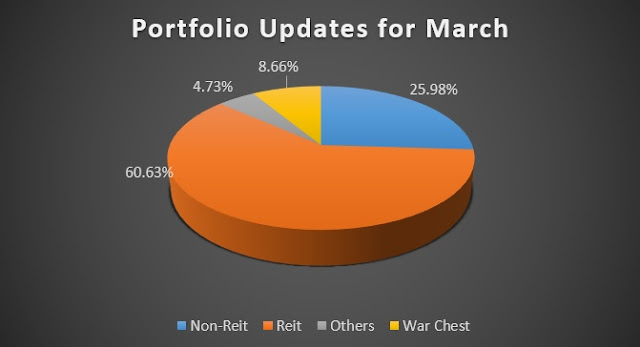

On personal level, this month sees the end of my 18 months journey in paying down my housing loan. Starting in January 2021, I no longer need to finance my house with cash, as the CPF itself is now sufficient to service the loan on its own. This neutralize the threat of a main liability and free up more funds to increase my cash holdings.

So, whats next?

For now, I am still working from home. Even with the opening of phase 3 in Singapore, it is unlikely there will be much changes in my job. There have been some plans laid out for 2021, but the pandemic has brought about some uncertainly in my plans that will require further reviews. Until then, we shall see.

Stay strong, mankind. Nothing last forever. So does the pandemic.