Another year ending. And what a year indeed. One journey end while another begins.

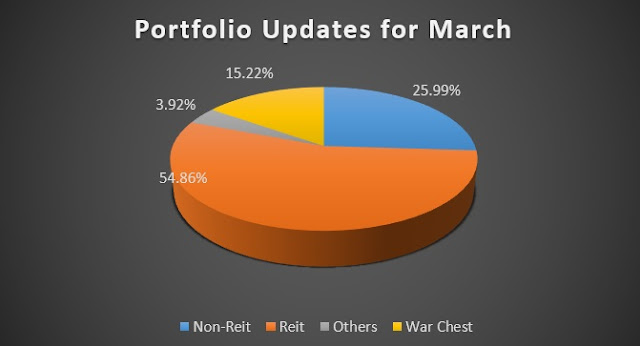

My financial journey took a dramatic end as the last payout month of the year turns out to be more than I had projected. But it still fall a little short of my target. There has been some up and down on the market cycle, and I did inject some funds into it to boast my portfolio. However, I let go one under performed counter and took some losses. Not much I can do about it, just some of the silly mistakes I made in the early days when I begun my financial journey and so now I paid a price for it. Cough Cough. So how far I come close to my targets? Very close, it is just a short of $500. Ah................well, a small tree grow at a slow pace.

Other than adjusting the portfolio, I ventured into another platform. A unit-trust dividend scheme that also pay out some dividend on an interval period. It was small, and just something else to diversify my options. So, the next following months and perhaps year we could see some additional passive pay out from these investment funds. Unlike a fixed deposit fund, these unit-trust are not protected under the Singapore investment scheme and subjected to value loss or gains. Not suitable for the those who wanted to protect the capital at all cost. LOL.

The world affairs has not been well and it certainly had much impact on our lives. Both the war in Ukraine and the pandemic has been the main drive of many events. Inflation has been rising like crazy and things that we see at this price today becomes another on the next day. Household has been trying to adjust their life accordingly to control expenses. Friends and neighbors has been complaining the rising costs and slow income raise. When I look to myself, I wondered if I would have been in much dire situation had I not built up my financial knowledge and ventured beyond my salaried job to built a passive income. In fact, when I started my financial journey I had only thought of earning some extra pocket money to spend from my portfolio. As the years passed, I begun to realise how much advantages a well-built portfolio could offered. Now in face of rising inflation and lack of career advancement, my portfolio served as a cushion against all the uncertain storms. A small financial journey begun 17 years ago now turns out to be a blessing as I am now more resilient against financial crisis and could hope to rely upon my portfolio to sustain my household should things turns worse.

One of my longtime classmates has recently begun to embark on his own financial journey to build a portfolio. Although he is already in late forties, it is better than not even doing anything to improve his financial knowledge. Singapore has a several advantages when comes to making a choice in building a financial portfolio, we got access to numerous investment information and platforms to find ones that suit us. We are also well connected to world platforms should we want to expand our knowledge to our world beyond.

As I mentioned last year, I took a small step exploring the cryptocurrency. I invested a very small amount to try out and I find it unsuitable to my criteria. I still much prefer the traditional bricks and mortar like stocks and property. LOL. So, I guess I will ignore it for now.

Some of my friends lamented about the world affairs and its impact on Singapore. A few others got a hit and retrenched from their job. From what I see, it is going to be a long term affair and the world will need a very long time to recover. I predicted likely to be 5 years, maybe even more. Not very promising years ahead.

Despite so much uncertain events, I am still making a long term plans to move from my current corporate careers into a role that offered me more time for myself. Yes, I am not even 55 years old to get my first CPF payout, but I am looking further ahead of my life. If I am to see it, I see myself still has around 15 functional years ahead, maybe less. I hope to do the things I wanted to do. Naturally, for that to happen, my portfolio would need to grow to a certain strength to finance myself when I lose my salaried job. I can already feel the weight of the time getting over me and so I hope to fulfill whatever things I had yet explore to finish it while I am still functioning.

So what I intent to do when that day comes?

Secret. Mu hahahahah....!!!!

Happy New Year!!!!!!!!!!!!!