The worldly affairs are not good. Wars and natural disaster. Earth seems to be facing a crisis. And it is frightening just to think about it. All we need is just one idiot to press the button to unleash nuclear war and the world we know now shall disappear. We all now stand on the brink of human extinction.

Another year ending. A rather unhealthy year for me, many medical issues, guess that is part of aging journey. The health concern once more reminds me of the limits of mortality. How much time left for me to pursue the path I wanted to take before my life ends?

So, where do I stand now?

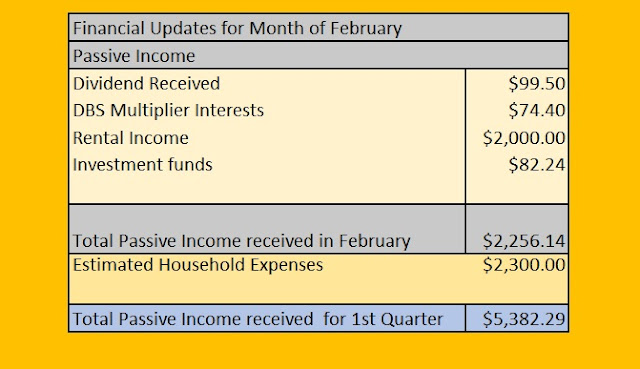

After reviewing my portfolio for the year 2023, it turns out to be better than I have predicated. I have carried out some adjustment to my portfolio many months back to consolidate my holdings, the aims are to establish a more sustainable portfolio which will provide a consistent return for long term. Not an easy choice, I took some losses and let go under-performed counters and diverted some to better performance counters. So, why do I suddenly decide to make such changes?

This year form my next resolution as I started to carry out preparations to exit the rat race. Yes, after almost 30 years in the employment sector I am considering leaving the workforce and start pursue my own life. There are many things I wish to do and accomplish. The limits of mortality remind me that I may not have enough time to finish the things I wanted to accomplish. This is exactly the motivation that pushed me to achieve financial independence. Now that I am coming to 50, soon I will be half a century old in this world.

So, how do I make my preparations?

Apart from consolidating my portfolio, there are several things I need to prepare as well.Firstly, the housing loan which had eating away my CPF are finally coming to an end. By January 2024, I will be able to clear my housing loan. That means I shall be debtless. Aye! No more debts!

Second – build up a strong reserve army. While the portfolio generates my income, my reserve army will fight any unforeseen events.

Third - Make sure I have enough insurance coverage. While I do have coverage, my family must rely on the basic MediShield for their health coverage. So, that means I would need to build up a strong reserve army.

Fourth - Capped my CPF Saving account which will form part of my retirement funds in future.

Fifth – Plan my next 10 years journey. This is important. I have witnessed retirees after retiring from their employment suddenly find themselves nothing to do in their life, and they started to get sick from inaction. The truth is they have dedicated their life in a non-stop cycle of working life, but never have much goals for themselves. I shall not be in that situation. Naturally, I would not be staying home and play games, that is not healthy. LOL.

Still, after 30 years in the employment world. It is kind of scary to think about it, leaving a system that has been consistently paying me by trading my time for it. The decision is not easy to make, likely I can expect to face some criticism from conservative people for making such drastic move. And I know very well it will not be easy to start over in a new employment at my current age should things turns ugly, especially in Singapore.

There is an old saying ‘Fortune favors the brave ones who face the unknown,’ I wonder will I have the courage for it when the time comes. Well, let us see how it goes.

Happy NEW YEAR!!!