A short quote from the drama series ' The Game of Throne'.

But for here, its something else.

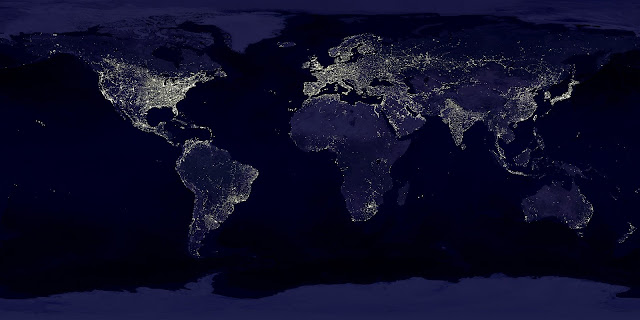

Many had said Covid-19 would gets under control during the warm seasons. June.....July.....August.....and now Sept is ending soon. The cold seasons is near. Winter is next. The Pandemic might just gets a boaster that will sweep across the world like a curtain of death. Hmm.. not too encouraging...isn't it.

And then we gets this. Pandemic 2022

Oh uh, its likely going to be a 2 years affairs!! In 1918, the Spanish Flu wipe out 500 million people over a period of 2 years over four successive waves. And....we are only seeing just one wave of Covid-19.

Will the Pandemic be much worse than the Spanish Flu above? Although we are in modern times now. but the truth remains. Until there is a direct cure to it. this thing will stay on much longer because humans engagements remains. Things like social distancing and border restrictions will be around for a long time.

That said. The impact on the economy and the market is obvious. THE MARKET will likely not recover within 2 years. Its always seem like 2 years is an average time for a situation to recover. 2008 Global Financial Crisis and Oil Crisis of 2015/16. Both took 2 years to recover.

So what do we do?

We continued with our lives. Eat healthy, live healthy. Whatever investments we have, we stick to the rules. Stay sustainable. Investments that can sustain during a crisis will likely recover when the situation recovers. If 2 years is the standard formula for recovery, it is possible to see the market recover by 2022.

Its a long wait!!!

Yes, so does the world. Humanity has learned to live with crisis and disasters since the beginning of time and survived. If they had done it, so can we. Ahem, assuming a meteor do not suddenly decide to end our existence like they did to our dinosaurs. Ops...

So how do we survived?Stick with the old plan. Don't spend unnecessary. Keep a watch on our investments. Be ready to divert to less risky portfolio if need to. Many banks has cut interests. dividends has been cut as well, profits and returns will be lesser, bonuses and promotion might be lesser or worst....zero. These are the likely things we will experience for the next 2 years. If this pandemic vanished early, good for humanity. If not, harvest the will and the determination to survive it through.

Lets us stay strong. Our forefathers has survived the centuries. It is our time now.